When it comes to choosing a new car, one important factor to consider is how much it will cost to insure. If you’re thinking about getting a hatchback, you might wonder if these cars are more expensive to insure compared to others. Hatchbacks, with their unique design and features, can affect insurance costs in different ways. In this article, we’ll explore what makes hatchbacks stand out, how insurance companies determine the cost of coverage, and whether or not hatchbacks are more costly to insure. We’ll break down the details so you can better understand what to expect and find ways to keep your insurance costs down.

Why Hatchbacks Might Be More Expensive to Insure?

There are several reasons why hatchbacks might be more expensive to insure compared to other types of vehicles. Here are some key factors:

- Repair and Maintenance Costs: Hatchbacks, especially sporty or high-performance models, might have higher repair and maintenance costs due to specialized parts or design. Higher repair costs can lead to higher insurance premiums.

- Safety Ratings: Although many hatchbacks have good safety ratings, some models might have less favorable ratings compared to larger vehicles like SUVs or sedans. Lower safety ratings can result in higher insurance premiums due to increased risk.

- Theft Risk: Certain hatchbacks are more likely to be targeted by thieves, leading to higher insurance rates. If a specific model is frequently stolen, insurers may raise premiums to account for this higher risk.

- Cost of Replacement Parts: If the hatchback model has expensive or hard-to-find replacement parts, insurance companies might increase premiums to cover potential repair costs.

- Performance and Driving Style: Hatchbacks are often marketed as sporty or high-performance vehicles. If a hatchback is perceived as having higher performance capabilities, it might be associated with riskier driving behavior, leading to higher insurance premiums.

- Driver Demographics: Hatchbacks might attract a younger demographic, who statistically have higher accident rates. This can result in higher premiums if the insured driver is considered higher risk.

- Insurance Provider Policies: Different insurance providers may have varying criteria for insuring hatchbacks. Some may consider them higher risk based on their specific policies or historical data.

By understanding these factors, you can better navigate the complexities of insuring a hatchback and potentially find ways to lower your insurance costs.

Comparison With Other Vehicle Types

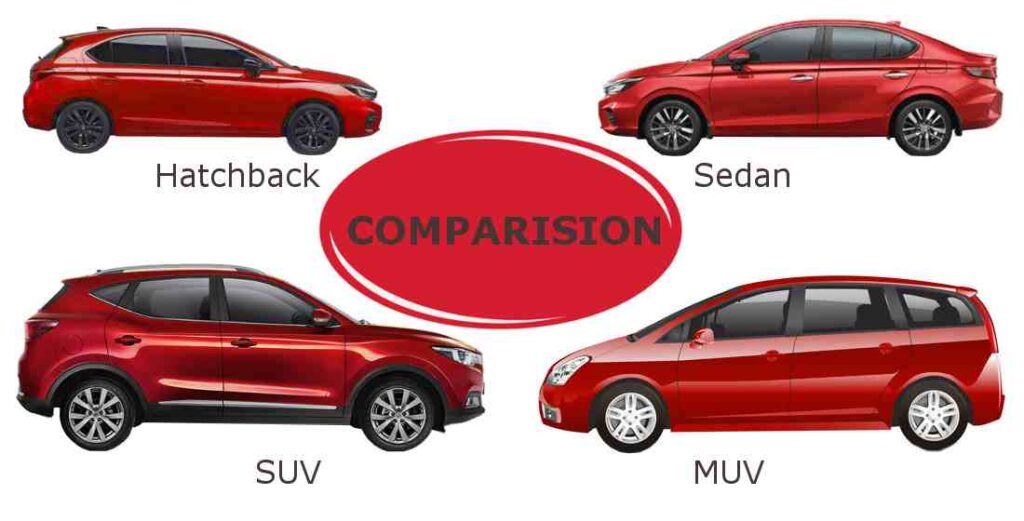

When comparing insurance costs between hatchbacks, sedans, and SUVs, it’s important to consider that these costs can vary based on numerous factors such as the specific model, the driver’s profile, location, and the insurance provider. Here is a general comparison based on average insurance costs:

- Sedans: Sedans are typically associated with higher insurance costs due to their popularity and the higher cost of some models. For example, the average annual insurance cost for a Honda Accord, a common sedan, is approximately $1,922.

- SUVs: On average, SUVs tend to be less expensive to insure than sedans. This is often attributed to their perceived safety and lower theft rates. For instance, the Honda CR-V, a popular SUV, has an average annual insurance cost of about $2,346.

- Hatchbacks: Insurance costs for hatchbacks can be less than sedans and SUVs, mainly due to their lower initial purchase price and potentially lower repair costs. However, the rates can be influenced by the model’s safety features and theft rates. The Chevrolet Cruze, a well-known hatchback, has an average annual insurance cost of $1,642.

It’s interesting to note that while SUVs are generally more expensive to purchase than sedans and hatchbacks, they often come with lower insurance premiums. This could be because they are considered safer and may have better crash-test results, leading to fewer and less costly claims.

Remember, these figures are averages and the actual insurance cost can vary. It’s always recommended to get personalized quotes from multiple insurance providers to find the best rate for your specific vehicle and circumstances.

Safety Ratings of Hatchbacks

When it comes to safety ratings, hatchbacks can be quite impressive. Here are some of the top-rated hatchbacks based on safety evaluations:

1. Honda Fit

The Honda Fit consistently ranks high in safety ratings. It has received a perfect 10 out of 10 safety score from iSeeCars. The Fit is equipped with advanced safety features such as:

- Advanced Driver-Assistance Systems (ADAS): Including lane-keeping assist, adaptive cruise control, and automatic emergency braking.

- Crash Test Performance: Excellent ratings in both NHTSA and IIHS crash tests.

2. Volkswagen Golf

The Volkswagen Golf is another hatchback that excels in safety. It also scores highly in safety evaluations. Key safety features include:

- Multiple Airbags: Front, side, and curtain airbags.

- Electronic Stability Control (ESC): Helps maintain control during extreme steering maneuvers.

3. Mazda3 Hatchback

The Mazda3 Hatchback is praised for its safety features and crash test results. It has earned a Top Safety Pick+ award from IIHS. Notable safety features are:

- Blind-Spot Monitoring: Alerts drivers to vehicles in their blind spots.

- Rear Cross-Traffic Alert: Warns of approaching traffic when backing up.

4. Toyota Prius

The Toyota Prius hatchback is known for its reliability and safety. It has received high safety ratings and includes a suite of standard safety features:

- Pre-Collision System: Detects potential collisions and applies brakes if necessary.

- Lane Departure Alert: Warns if the vehicle starts to drift out of its lane.

5. Hyundai Veloster

The Hyundai Veloster is another hatchback that scores well in safety tests. It includes features such as:

- Forward Collision-Avoidance Assist: Detects and helps prevent potential collisions.

- Driver Attention Warning: Monitors driver behavior and suggests breaks if signs of fatigue are detected.

6. Chevrolet Sonic

The Chevrolet Sonic hatchback also ranks highly for safety. It offers:

- StabiliTrak® Electronic Stability Control System: Enhances control, especially during emergency maneuvers.

- Rear Vision Camera: Provides a view of the area behind the vehicle when in reverse.

These hatchbacks not only offer excellent safety features but also perform well in crash tests, making them some of the safest options available in 2024.

Key Safety Features in Hatchbacks

- Airbags: Most modern hatchbacks come with multiple airbags, including front, side, and curtain airbags.

- Anti-lock Braking System (ABS): This helps prevent the wheels from locking up during braking, maintaining steering control.

- Electronic Stability Control (ESC): ESC helps maintain vehicle control during extreme steering maneuvers.

- Advanced Driver-Assistance Systems (ADAS): Features like lane departure warning, adaptive cruise control, and automatic emergency braking are becoming standard in many hatchbacks.

- Crumple Zones: Crumple zones are designed areas of the car that absorb and dissipate energy during a crash, reducing the impact force on passengers.

- Rearview Camera: A rearview camera assists drivers when reversing by providing a clear view of what’s behind the car, helping to avoid obstacles and pedestrians.

- Adaptive Cruise Control (ACC): ACC automatically adjusts the vehicle’s speed to maintain a safe following distance from the car ahead, reducing the need for constant acceleration and braking in traffic.

- Automatic Emergency Braking (AEB): AEB detects an impending collision with another vehicle or obstacle and automatically applies the brakes to prevent or minimize the impact.

These safety features contribute to making hatchbacks safer for both drivers and passengers, while also positively influencing insurance premiums.

Statistical Data and Trends

The latest trends in car insurance costs indicate a significant increase. Here are some key points based on the most recent data:

- Car insurance premiums have risen by 22.6% over the past year, marking the 28th consecutive month of growth.

- This increase is substantially higher than the current annual inflation rate of 3.4%.

- The cost of car repairs has gone up by 9.8%, and the combined maintenance and repair costs have increased by 7.6%.

- The underwriting performance of private auto insurance companies improved by about 7 percentage points in 2023 to 104.9%. This means that for every $100 in premiums received, insurers paid out $104.90.

- The rise in premiums is motivating more consumers to shop around for new policies. According to the J.D. Power 2024 U.S. Insurance Shopping Study, almost 49% of auto insurance customers surveyed are actively looking for a new policy.

Factors contributing to the rise in car insurance premiums include:

- Soaring repair costs: Higher prices for auto parts and labor, especially with newer cars that have more sophisticated technology.

- Increase in accidents: A 14% rise in insurance claims related to car crashes since 2020, with claim severity jumping 36%.

- Spike in auto theft: Car theft rates increased by 29% in 2023 in the 34 cities included in a year-end report.

- More severe weather: An increase in catastrophic weather events causing more vehicle damage.

Are Sports Cars More Expensive to Insure?

These statistics reflect a notable trend in the car insurance industry, where costs are escalating at a pace not seen since the 1970s. Consumers need to stay informed about these trends as they can significantly impact the cost of owning and operating a vehicle.

How to Lower Insurance Costs

Here are some tips that hatchback owners can consider to potentially lower their insurance costs:

- Shop Around: Don’t settle for the first insurance quote you receive. Compare rates from multiple insurers to find the best deal.

- Bundle Policies: If you have other insurance policies, such as homeowners or renters insurance, bundling them with your auto insurance can lead to discounts.

- Increase Deductibles: Opting for higher deductibles can lower your premiums, but make sure you can afford the deductible if you need to make a claim.

- Look for Discounts: Insurers offer various discounts, such as for safe driving, having multiple vehicles, or installing anti-theft devices.

- Pay Annually: Paying your premium in full annually rather than in monthly installments can save you money over time.

- Maintain a Clean Driving Record: Safe driving habits can lead to fewer accidents and traffic violations, which can help keep your premiums low.

- Choose the Right Coverage: Only buy the coverage you need. For example, if you have an older hatchback, you might opt out of collision coverage.

- Defensive Driving Courses: Completing an approved defensive driving course can often provide a discount on your insurance premium.

- Drive a Lower-Powered Car: Hatchbacks with smaller engines are often cheaper to insure than those with larger, more powerful engines.

- Credit Score: A good credit score can influence your insurance rates, so it’s beneficial to maintain a healthy credit history.

By implementing these strategies, hatchback owners can take proactive steps to manage and potentially reduce their car insurance costs.

FAQs

Q 1. What is the difference between third-party and comprehensive insurance for hatchbacks?

Ans. Third-party insurance covers damages to other parties’ property and injuries in an accident where you are at fault. It is the minimum legal requirement, while Comprehensive insurance covers damages to your own vehicle as well as third-party liabilities. It includes coverage for theft, vandalism, natural disasters, and accidents.

Q 2. How does the age of a hatchback affect insurance premiums?

Ans. Generally, the older a hatchback gets, the lower its value, which can lead to lower insurance premiums. However, very old vehicles might lack modern safety features, potentially leading to higher premiums.

Q 3. Is there a difference in insurance costs for hatchbacks with manual vs. automatic transmissions?

Ans. Manual transmission hatchbacks can be cheaper to insure than automatic ones. This is because manual cars are generally less expensive and considered less risky to insure.

Q 4. What role does the engine size of a hatchback play in determining insurance costs?

Ans. Engine size can significantly affect insurance premiums. Hatchbacks with smaller engines are usually cheaper to insure than those with larger, more powerful engines.

Q 5. Are there any specific insurance add-ons recommended for hatchback owners?

Ans. Yes, hatchback owners may consider add-ons like zero depreciation cover, engine protection, roadside assistance, personal accident cover, and key replacement cover to enhance their insurance coverage.

Q 6. How often should I review and potentially update my hatchback insurance policy?

Ans. It’s recommended to review your insurance policy annually or whenever there is a significant change in your life, such as a change in marital status, moving to a new location, or purchasing a new vehicle.

Conclusion

In conclusion, whether hatchbacks are more expensive to insure depends on various factors like safety ratings, repair costs, and the specific model. Hatchbacks often have lower insurance costs compared to sedans and SUVs due to their smaller size and lower repair expenses. They also come with many safety features that can help reduce insurance premiums.

When choosing a car, it’s important to consider not just the purchase price but also the ongoing costs like insurance. By understanding the factors that affect insurance rates, you can make a more informed decision and potentially save money in the long run.

Join Shubham, a finance enthusiast with a mission to empower readers with the knowledge and tools to achieve financial freedom. Discover smart financial advice and unlock your financial potential.