When it comes to choosing a car, the humble hatchback often stands out for its compact size, versatile design, and generally affordable price tag. However, the cost of ownership extends beyond the dealership, with insurance premiums playing a significant role in the long-term expenditure of a vehicle. The question arises, are hatchbacks more expensive to insure compared to other types of vehicles, such as sedans or SUVs?

This article takes a closer look at car insurance, especially for hatchbacks. We’ll break down the factors that affect insurance costs, like safety ratings and theft rates. We’ll also discuss how the specific features of hatchbacks can impact their insurance rates and see if the idea that smaller cars always mean higher premiums is really true.

By diving into statistics, expert insights, and real-life examples, we aim to give you a clear picture of what influences insurance costs for hatchbacks.

Introduction to Hatchbacks and Insurance

A hatchback is a type of car known for its unique design. What sets it apart is the rear door, which swings upward to open up the main interior space for cargo, unlike a traditional car that just has a separate trunk. This rear door, often called a hatch, is hinged at the roof, making it easy to load and unload items.

Most hatchbacks use a two-box design body style, where the cargo area (trunk/boot) and passenger areas are a single volume. The rear seats can often be folded down to increase the available cargo area. Hatchbacks may feature fold-down second-row seating, where the interior can be reconfigured to prioritize passenger or cargo volume.

When describing the body style, the hatch is often counted as a door, therefore a hatchback with two passenger doors is called a three-door and a hatchback with four passenger doors is called a five-door.

Here’s why hatchback insurance costs might differ from other vehicle types:

- Vehicle Size: Hatchbacks are generally smaller and lighter than other types of vehicles like SUVs or trucks. This could potentially lead to lower repair costs in the event of an accident, which might result in lower insurance premiums.

- Safety Ratings: Insurance companies often consider the safety ratings of a vehicle when determining insurance costs. If a hatchback has high safety ratings, it might be less expensive to insure.

- Cost of Parts and Repairs: Hatchbacks, especially those from popular and common brands, often have parts that are readily available and less expensive than those of luxury or rare cars. This can lead to lower repair costs, which insurance companies might take into account when setting premiums.

- Vehicle Performance: High-performance vehicles often come with higher insurance costs due to the increased risk of accidents. Since hatchbacks are generally not high-performance vehicles, they might be less expensive to insure.

- Theft Rates: If a particular model of hatchback is less likely to be stolen, it might be cheaper to insure. Insurance companies often consider the theft rates of different vehicle models when determining insurance costs.

- Vehicle Age: Newer models of hatchbacks might be more expensive to insure than older models due to their higher replacement cost.

It’s important to note that while these factors can influence the cost of insuring a hatchback, the actual insurance premium will vary based on individual circumstances, including the driver’s history, location, and the specific insurance company’s policies.

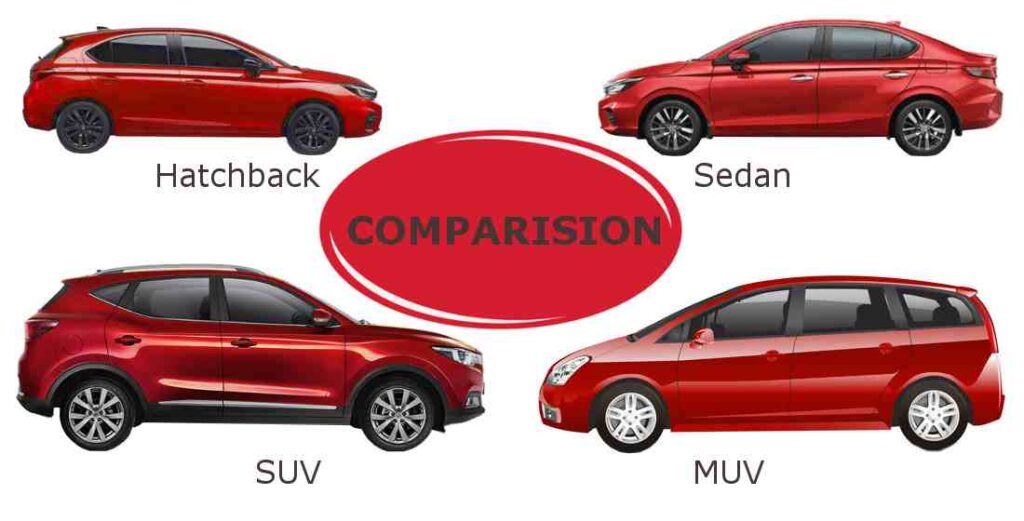

Comparison with Other Vehicle Types

When comparing insurance costs between hatchbacks, sedans, and SUVs, it’s important to consider that these costs can vary based on numerous factors such as the specific model, the driver’s profile, location, and the insurance provider. Here is a general comparison based on average insurance costs:

- Sedans: Sedans are typically associated with higher insurance costs due to their popularity and the higher cost of some models. For example, the average annual insurance cost for a Nissan Altima, a common sedan, is approximately $2,089.

- SUVs: On average, SUVs tend to be less expensive to insure than sedans. This is often attributed to their perceived safety and lower theft rates. For instance, the Honda CR-V, a popular SUV, has an average annual insurance cost of about $1,808.

- Hatchbacks: Insurance costs for hatchbacks can be less than sedans and SUVs, mainly due to their lower initial purchase price and potentially lower repair costs. However, the rates can be influenced by the model’s safety features and theft rates. The Chevrolet Cruze, a well-known hatchback, has an average annual insurance cost of $1,508.

It’s interesting to note that while SUVs are generally more expensive to purchase than sedans and hatchbacks, they often come with lower insurance premiums. This could be because they are considered safer and may have better crash-test results, leading to fewer and less costly claims.

Remember, these figures are averages and the actual insurance cost can vary. It’s always recommended to get personalized quotes from multiple insurance providers to find the best rate for your specific vehicle and circumstances.

Safety Ratings of Hatchbacks

Safety ratings play a key role in helping buyers understand how well a car can protect its passengers in a crash. Hatchbacks, like any other type of car, go through thorough testing to assess their safety. Here’s a look at how hatchbacks stack up in terms of safety ratings.

- Insurance Institute for Highway Safety (IIHS): The IIHS awards the Top Safety Pick and Top Safety Pick+ to vehicles that excel in crashworthiness and crash avoidance. For 2024, several hatchbacks have received these prestigious awards, indicating high levels of safety. For example, the 2024 Acura Integra and the 2024 Toyota Prius are among the hatchbacks that have earned the Top Safety Pick+ designation.

- National Highway Traffic Safety Administration (NHTSA): The NHTSA provides star ratings based on comprehensive crash tests. According to iSeeCars.com, the Honda Fit hatchback non-hybrid/electric received a perfect 10 out of 10 score, making it one of the safest hatchbacks for 2024.

- Global NCAP: The Global NCAP conducts safety assessments of vehicles sold in various international markets. Indian hatchbacks, for instance, have been listed according to their Global NCAP safety ratings, which is a testament to the increasing focus on vehicle safety worldwide.

- Euro NCAP: The European New Car Assessment Programme (Euro NCAP) provides safety ratings for vehicles sold in Europe, offering consumers information about the safety performance of cars.

These ratings are based on several factors, including adult and child occupant protection, pedestrian protection, and the availability and effectiveness of safety-assist technologies. Vehicles that score well in these tests are generally considered safer choices for consumers. Buyers need to review these safety ratings when considering a hatchback purchase, as they can significantly impact the overall safety of the vehicle and its occupants.

Statistical Data and Trends

The latest trends in car insurance costs indicate a significant increase. Here are some key points based on the most recent data:

- Car insurance premiums have risen by 22.6% over the past year, marking the 28th consecutive month of growth.

- This increase is substantially higher than the current annual inflation rate of 3.4%.

- The cost of car repairs has gone up by 9.8%, and the combined maintenance and repair costs have increased by 7.6%.

- The underwriting performance of private auto insurance companies improved by about 7 percentage points in 2023 to 104.9%. This means that for every $100 in premiums received, insurers paid out $104.90.

- The rise in premiums is motivating more consumers to shop around for new policies. According to the J.D. Power 2024 U.S. Insurance Shopping Study, almost 49% of auto insurance customers surveyed are actively looking for a new policy.

Factors contributing to the rise in car insurance premiums include:

- Soaring repair costs: Higher prices for auto parts and labor, especially with newer cars that have more sophisticated technology.

- Increase in accidents: A 14% rise in insurance claims related to car crashes since 2020, with claim severity jumping 36%.

- Spike in auto theft: Car theft rates increased by 29% in 2023 in the 34 cities included in a year-end report.

- More severe weather: An increase in catastrophic weather events causing more vehicle damage.

Are Sports Cars More Expensive to Insure?

These statistics reflect a notable trend in the car insurance industry, where costs are escalating at a pace not seen since the 1970s. It’s important for consumers to stay informed about these trends as they can significantly impact the cost of owning and operating a vehicle.

How to Lower Insurance Costs

Here are some tips that hatchback owners can consider to potentially lower their insurance costs:

- Shop Around: Don’t settle for the first insurance quote you receive. Compare rates from multiple insurers to find the best deal.

- Bundle Policies: If you have other insurance policies, such as homeowners or renters insurance, bundling them with your auto insurance can lead to discounts.

- Increase Deductibles: Opting for higher deductibles can lower your premiums, but make sure you can afford the deductible if you need to make a claim.

- Look for Discounts: Insurers offer various discounts, such as for safe driving, having multiple vehicles, or installing anti-theft devices.

- Pay Annually: Paying your premium in full annually rather than in monthly installments can save you money over time.

- Maintain a Clean Driving Record: Safe driving habits can lead to fewer accidents and traffic violations, which can help keep your premiums low.

- Choose the Right Coverage: Only buy the coverage you need. For example, if you have an older hatchback, you might opt out of collision coverage.

- Defensive Driving Courses: Completing an approved defensive driving course can often provide a discount on your insurance premium.

- Drive a Lower-Powered Car: Hatchbacks with smaller engines are often cheaper to insure than those with larger, more powerful engines.

- Credit Score: A good credit score can influence your insurance rates, so it’s beneficial to maintain a healthy credit history.

By implementing these strategies, hatchback owners can take proactive steps to manage and potentially reduce their car insurance costs.

Future of Hatchback Insurance

The future of hatchback insurance, like the broader auto insurance industry, is poised for significant changes driven by technological advancements and shifts in consumer behavior. Here are some key trends that are likely to shape the future of hatchback insurance:

- Autonomous and Electric Vehicles: The rise of autonomous vehicles (AVs) and electric vehicles (EVs) is expected to have a profound impact on the auto insurance industry. As these technologies become more prevalent, we may see a shift in liability from drivers to manufacturers and technology providers.

- Usage-Based Insurance (UBI): UBI, which calculates premiums based on actual driving behavior and mileage, is becoming increasingly popular. This could benefit hatchback drivers who use their vehicles less frequently or predominantly for short urban trips.

- Telematics: The integration of telematics devices in vehicles allows insurers to collect real-time data on driving patterns. This can lead to more personalized insurance rates and potentially lower costs for safe hatchback drivers.

- Insurance Premiums: Advances in safety features and autonomous technology may lead to a decrease in accidents, which could result in lower insurance premiums. However, the higher cost of repairing technologically advanced vehicles might offset these savings.

- Changing Ownership Models: The trend towards shared mobility and car subscriptions could alter the traditional car ownership model, impacting how insurance is purchased and bundled with other services.

- Regulatory Changes: As AVs and EVs become more common, regulations will evolve to address the new risks and liabilities associated with these vehicles, which will affect insurance policies and rates.

- Cybersecurity and Data Privacy: With vehicles becoming more connected, cybersecurity risks increase. Insurers may offer policies that cover cyber threats, and hatchback owners will need to be aware of the implications for their insurance coverage.

- Environmental Factors: Climate change and the increasing frequency of severe weather events could influence insurance costs. Hatchbacks, being smaller and lighter, might be considered at higher risk in certain conditions, potentially affecting premiums.

These trends suggest that hatchback insurance will continue to evolve, with a focus on technology, safety, and consumer preferences.

Regional Insurance Cost Variations

Insurance costs for vehicles, including hatchbacks, can indeed vary significantly by region. Here are some key factors that contribute to this variation:

- Population Density: Areas with high population density, such as urban cities, often have higher insurance rates. This is because the risk of accidents, theft, and vandalism is typically higher in densely populated areas.

- State Regulations: Each state in the U.S. has its own regulations for auto insurance, which can affect the cost. For instance, states with no-fault insurance laws, where each driver’s insurance pays for their own injuries regardless of who caused the accident, often have higher insurance costs.

- Weather Conditions: Regions with severe weather conditions, such as hail, heavy snow, or frequent storms, may have higher insurance costs due to the increased risk of damage.

- Crime Rates: Areas with high crime rates, especially auto theft and vandalism, often have higher insurance premiums.

- Average Cost of Repairs: Repair costs can vary depending on the region, which in turn affects insurance premiums. If you live in an area where parts and labor are pricier, you might end up paying more for insurance.

- Traffic Conditions: Regions with heavy traffic congestion might have higher insurance costs due to the increased risk of accidents.

Here are some specific examples based on data from 2023:

- The national average cost of car insurance in 2023 was $3,017, which amounts to about $251 a month.

- Michigan had the highest average annual car insurance premium in 2023: $5,766, which comes out to $480 a month.

- Hawaii had the lowest average annual car insurance premium in 2023: $1,619, which comes out to $135 a month.

Please note that these figures are averages and the actual cost can vary based on many factors, including the make and model of the hatchback, the driver’s age and driving history, and more.

FAQs

Q 1. What is the difference between third-party and comprehensive insurance for hatchbacks?

Ans. Third-party insurance covers damages to other parties’ property and injuries in an accident where you are at fault. It is the minimum legal requirement, while Comprehensive insurance covers damages to your own vehicle as well as third-party liabilities. It includes coverage for theft, vandalism, natural disasters, and accidents.

Q 2. How does the age of a hatchback affect insurance premiums?

Ans. Generally, the older a hatchback gets, the lower its value, which can lead to lower insurance premiums. However, very old vehicles might lack modern safety features, potentially leading to higher premiums.

Q 3. Is there a difference in insurance costs for hatchbacks with manual vs. automatic transmissions?

Ans. Manual transmission hatchbacks can be cheaper to insure than automatic ones. This is because manual cars are generally less expensive and considered less risky to insure.

Q 4. What role does the engine size of a hatchback play in determining insurance costs?

Ans. Engine size can significantly affect insurance premiums. Hatchbacks with smaller engines are usually cheaper to insure than those with larger, more powerful engines.

Q 5. Are there any specific insurance add-ons recommended for hatchback owners?

Ans. Yes, hatchback owners may consider add-ons like zero depreciation cover, engine protection, roadside assistance, personal accident cover, and key replacement cover to enhance their insurance coverage.

Q 6. How often should I review and potentially update my hatchback insurance policy?

Ans. It’s recommended to review your insurance policy annually or whenever there is a significant change in your life, such as a change in marital status, moving to a new location, or purchasing a new vehicle.

Conclusion

In conclusion, the cost of insuring a hatchback, like any vehicle, is influenced by a multitude of factors. These include the car’s make and model, safety features, cost of parts and repairs, and even the region in which you live. While hatchbacks may sometimes be cheaper to insure due to their smaller size and lower repair costs, this is not always the case.

It’s crucial to remember that each insurance company uses its own formula to calculate premiums, so rates can vary significantly from one provider to another. Therefore, whether you’re a current hatchback owner or considering becoming one, it’s always a good idea to shop around and compare quotes from multiple insurance providers to ensure you’re getting the best deal.

Join Shubham, a finance enthusiast with a mission to empower readers with the knowledge and tools to achieve financial freedom. Discover smart financial advice and unlock your financial potential.