Owning a home brings a lot of duties, and one of the most important is keeping your home’s structure strong. One common issue that homeowners face is wood rot, a slow but steady decay that can compromise the strength of your home’s wooden structures. But when wood rot sets in, does your homeowners insurance cover the damage? This is a question that plagues many homeowners.

Let’s dive into the details of homeowners insurance and its coverage when it comes to wood rot. We’ll look at what causes wood rot, how insurance policies usually handle it, and what you can do to prevent it. Whether you’re a new homeowner or have been living in your house for years, knowing what your insurance covers is crucial. So, let’s break down the ins and outs of homeowners insurance and wood rot together.

Understanding Rotting Wood

Understanding rotting wood is crucial for homeowners looking to navigate insurance coverage effectively. Here are some key points to include:

Causes of Wood Rot

- Moisture: This is the primary cause of wood rot. Wood that is consistently exposed to water, such as from leaks, poor drainage, or high humidity, can begin to rot. The moisture provides an ideal environment for the fungi that cause wood rot to grow.

- Lack of Ventilation: Areas of your home that are poorly ventilated can trap damp air, leading to higher humidity levels. Over time, this can cause wood to start rotting.

- Condensation: When warm air comes into contact with a cold surface, it can cause condensation. If this happens regularly on your wooden surfaces, it can lead to wood rot.

- Poorly Sealed Windows and Doors: If your windows and doors aren’t properly sealed, they can let in moisture, which can then lead to wood rot.

- Roof Leaks: Leaks in your roof can allow water to seep into your home’s wooden structures, causing them to rot over time.

- Plumbing Leaks: Leaks in your plumbing can also lead to wood rot, as they can cause wooden structures to be exposed to water consistently.

Types of Wood Rot

- Dry Rot: Dry rot is caused by a specific type of fungus that can travel through masonry and other materials to find wood. Despite its name, dry rot requires some moisture to get started but can spread through dry wood, causing extensive damage.

- Wet Rot: Wet rot occurs when wood is consistently exposed to moisture. It usually stays confined to the damp area, causing the wood to feel spongy and weak. Wet rot is less destructive than dry rot but can still compromise the structural integrity of the affected wood.

Identifying Wood Rot

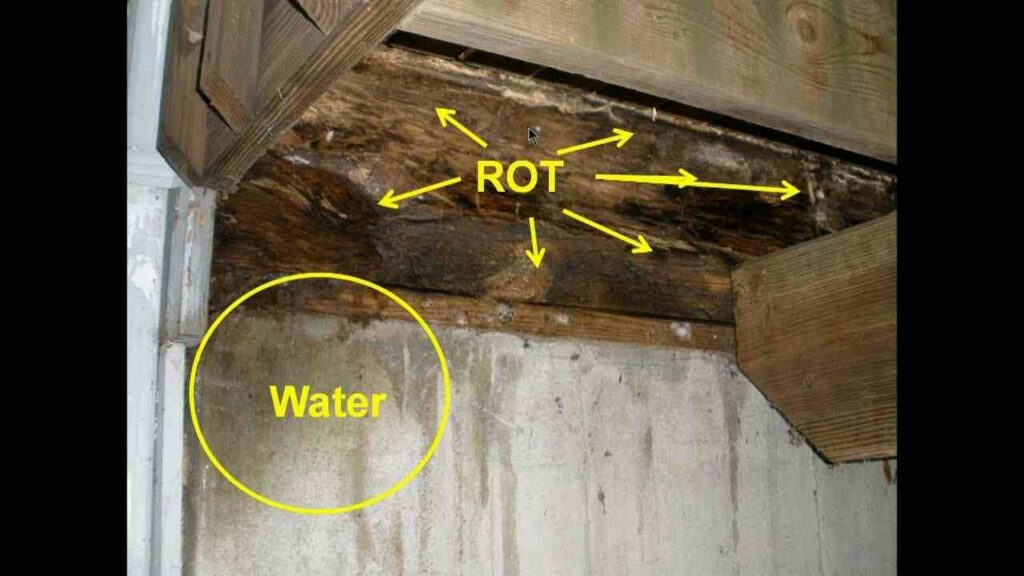

Wood rot is a serious issue that can compromise the structural integrity of your home if left unchecked. One of the most evident signs of wood rot is discoloration, where the wood may appear darker or lighter than the surrounding area. You might also notice a musty or damp smell, especially in enclosed spaces like basements or attics.

Physically, rotting wood can feel soft, spongy, or crumbly to the touch, and may break apart easily when prodded with a tool. In some cases, the wood may develop cracks or splits, and you might see fungus or mold growing on its surface. Peeling paint or wood that feels damp even in dry conditions can also be indicators. In more advanced stages

Common Areas Affected by Wood Rot

Wood rot commonly affects areas of the home that are frequently exposed to moisture and weather elements. The most susceptible areas include exterior wood surfaces such as siding, window sills, door frames, and decks. These spots often face direct contact with rain, snow, and humidity, which can lead to the accumulation of moisture, creating the perfect environment for rot to develop.

Inside the home, areas around plumbing fixtures such as sinks, bathtubs, and toilets are also vulnerable due to potential leaks and high humidity levels. Basements and crawl spaces, particularly if they have inadequate ventilation, can harbor moisture that encourages wood rot.

Home Insurance Costs for Older Homes

Understanding the causes, types, and signs of wood rot can help homeowners take preventative measures and address issues early, potentially saving on costly repairs and maintaining the integrity of their homes.

When Does Home Insurance Cover Rotting Wood?

Homeowners insurance typically covers rotting wood when it results from a sudden and accidental event that is listed as a covered peril in your policy. For instance, if a pipe bursts and causes water damage that leads to wood rot, your insurance may cover the repair costs. Similarly, damage caused by a storm, fire, or vandalism that results in wood rot may also be covered. In these cases, the key factor is that the rot is a direct result of a covered peril, and you promptly report and document the damage to file a claim.

When Doesn’t Home Insurance Cover Rotting Wood?

Homeowners insurance generally does not cover rotting wood due to lack of maintenance, gradual deterioration, or pest infestations. Insurance policies are designed to protect against sudden and unexpected damage rather than issues that could have been prevented through regular upkeep.

If wood rot is deemed to be a result of neglect, such as failure to repair a leaking roof or adequately protect against moisture, insurers are unlikely to cover the repairs. Homeowners need to understand their policy exclusions and take proactive steps to maintain their property to avoid potential coverage gaps related to wood rot.

Preventing Wood Rot

Here are some tips on how homeowners can prevent wood rot:

- Regular Inspections: Regularly inspect your home for signs of moisture damage, leaks, or wood rot. Early detection can prevent a small problem from becoming a big one.

- Proper Ventilation: Ensure that your home, especially areas like the attic and basement, are well-ventilated. This helps to keep these areas dry and prevents the buildup of moisture.

- Control Humidity: Use dehumidifiers in areas of your home that are prone to high humidity. High humidity can lead to condensation, which can cause wood rot.

- Seal Wood: If you have wooden structures or furniture in your home, consider sealing the wood with a water-resistant product. This can protect the wood from absorbing moisture.

- Fix Leaks: Promptly repair any leaks in your home. This includes everything from a leaking roof to a dripping pipe. The longer the wood is exposed to water, the more likely it is to rot.

- Proper Drainage: Make sure your home has proper drainage. If water collects near your home’s foundation, it can seep into your home and cause damage.

- Regular Maintenance: Regularly maintain all aspects of your home. This includes cleaning your gutters, maintaining your HVAC system, and keeping your home clean and dry.

- Install Flashing: Use metal flashing around doors, windows, and chimneys to direct water away from wood surfaces. Ensure the flashing is properly installed and in good condition.

- Monitor and Repair Caulking: Check caulking around windows, doors, and other joints regularly. Replace or repair cracked or missing caulk to prevent water infiltration.

Consequences of Not Paying Home Insurance

By following these tips, homeowners can significantly reduce the risk of wood rot and ensure their homes remain structurally sound and visually appealing.

The Claim Process

If a homeowner discovers wood rot and wants to make an insurance claim, the process generally involves several key steps. Here’s a detailed guide to help you understand how it works:

- Review Your Policy: Start by reviewing your homeowners insurance policy to determine if wood rot is covered. Typically, wood rot caused by gradual deterioration or lack of maintenance is not covered. However, if the rot is due to a sudden and accidental event, such as a burst pipe, it might be covered.

- Document the Damage: Take detailed photographs and videos of the affected areas. This documentation will be crucial when filing your claim. Make sure to capture the extent of the damage and any potential causes, such as water leaks.

- Contact Your Insurance Provider: Notify your insurance company as soon as possible. Provide them with all necessary information, including your policy details, the date you discovered the damage, and a description of the affected areas.

- Schedule an Inspection: Your insurance company will likely send an adjuster to inspect the damage. The adjuster will assess the extent of the wood rot and determine whether it falls under your policy’s coverage.

- Submit a Claim: If the adjuster confirms that the damage is covered, you will need to formally submit a claim. This usually involves filling out a claim form and providing the documentation you gathered.

- Estimate and Approval: The insurance company will review your claim and provide an estimate for the repair costs. If approved, they will inform you of the amount they will cover, minus any deductible you are responsible for.

- Repair the Damage: Once your claim is approved, you can proceed with repairing the wood rot. You may need to hire a contractor to carry out the repairs. Keep all receipts and invoices related to the repair work.

Remember, every insurance company’s process may vary slightly, and the specifics of your policy can also affect how your claim is handled.

FAQs

Q 1. What are the signs of a serious wood rot problem?

Ans. Signs of a serious wood rot problem include widespread areas of discolored or soft wood, a strong musty smell, visible fungal growth, and structural issues like sagging floors or ceilings.

Q 2. What types of wood are most resistant to rot?

Ans. Some types of wood are naturally more resistant to rot, including cedar, redwood, and white oak. Pressure-treated wood is also resistant to rot.

Q 3. How much does it typically cost to repair wood rot?

Ans. The cost to repair wood rot can vary widely depending on the extent of the damage and the specific repair needed. It can range from a few hundred dollars for minor repairs to several thousand dollars for major structural repairs.

Q 4. Can wood rot spread to other parts of the house?

Ans. Yes, if left untreated, the fungi that cause wood rot can spread to other areas of your home where conditions are favorable.

Q 5. What are the health risks associated with wood rot?

Ans. While wood rot itself is not typically a direct health risk, the damp conditions that cause wood rot can also lead to mold growth, which can cause health issues like allergies and respiratory problems.

Q 6. Does homeowners insurance cover mold damage?

Ans. Homeowners insurance typically does not cover mold damage unless it’s directly related to a “covered peril.” The insurance company will only cover mold damage if it was caused by something like a burst pipe, not if it was caused by neglect or lack of maintenance.

Conclusion

In conclusion, understanding whether homeowners insurance covers rotting wood requires a careful examination of your policy and the specific circumstances surrounding the damage. While most policies do not cover gradual deterioration due to neglect or poor maintenance, sudden and accidental events that lead to wood rot might be eligible for coverage.

Preventive measures, such as regular inspections and maintenance, are crucial in safeguarding your home against wood rot. By staying proactive, you can minimize the risk of damage and avoid potential disputes with your insurance provider.

If you do discover wood rot, documenting the damage and promptly contacting your insurer can streamline the claim process.

Luna Haverford is a home insurance specialist with over 4 years of experience in the field. Holding a CPCU (Chartered Property Casualty Underwriter) certification, Luna is dedicated to helping homeowners find the best coverage for their needs. As an author on the ‘FundFinesse’ blog, Luna writes clear, easy-to-understand articles about home insurance.