Choosing the right health insurance can feel overwhelming, especially with so many options available. One type of plan you might come across is a High Deductible Health Plan, or HDHP. These plans are known for their lower monthly costs, but they come with higher out-of-pocket expenses when you need care.

In this article, we’ll explore whether an HDHP is a good or bad choice. We’ll break down the pros and cons, explain who might benefit from this type of plan, and look at how it could impact your healthcare decisions and finances. By the end, you’ll have a better understanding of whether an HDHP is the right fit for you.

Introduction to HDHPs

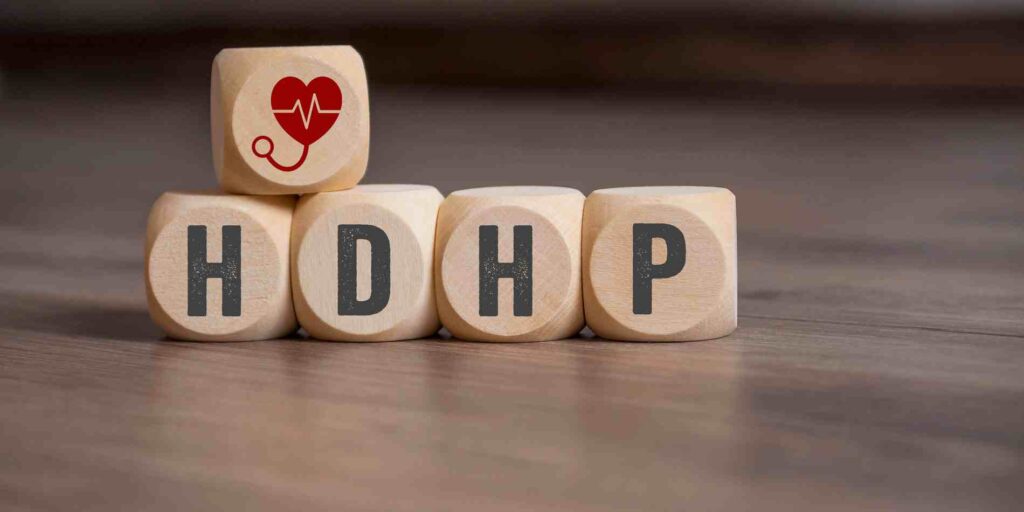

A High Deductible Health Plan (HDHP) is a type of health insurance that offers lower monthly premiums but comes with higher deductibles compared to traditional health plans. This means that while you save money on your monthly payments, you will need to pay more out-of-pocket for healthcare services before your insurance starts to cover the costs. For 2024, the IRS defines an HDHP as any plan with a deductible of at least $1,600 for an individual or $3,200 for a family. These plans also have higher out-of-pocket maximums, which is the most you would have to pay in a year for covered services, set at $8,050 for an individual and $16,100 for a family.

HDHPs are particularly popular among healthy individuals who do not expect to need frequent medical care, young adults who typically have fewer health issues, and those who are financially prepared to handle higher out-of-pocket costs if necessary. One of the benefits of HDHPs is that they often cover preventive care services, such as annual check-ups and screenings, without requiring you to meet the deductible first. This encourages individuals to maintain their health without worrying about additional costs.

Additionally, HDHPs are often paired with Health Savings Accounts (HSAs), which allow you to save money tax-free for medical expenses. Contributions to an HSA can be used to pay for deductibles, copayments, and other qualified medical expenses.

Benefits of HDHPs

High Deductible Health Plans (HDHPs) offer several advantages that can make them an attractive option for many individuals and families. Here are some key benefits:

- Lower Premiums: One of the most significant benefits of HDHPs is the lower monthly premiums. This can make health insurance more affordable, especially for those who do not require frequent medical care. By paying less each month, you can allocate those savings to other financial needs or investments.

- Health Savings Accounts (HSAs): HDHPs are often paired with Health Savings Accounts (HSAs), which provide a tax-advantaged way to save for medical expenses. Contributions to an HSA are tax-deductible, the funds grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This can result in substantial tax savings and help you manage healthcare costs more effectively.

- Employer Contributions: Many employers contribute to their employees’ HSAs, providing additional financial support for healthcare expenses. These contributions can help offset the higher out-of-pocket costs associated with HDHPs, making them more manageable.

- Preventive Care Coverage: HDHPs often cover preventive care services, such as annual check-ups, vaccinations, and screenings, without requiring you to meet the deductible first. This encourages individuals to maintain their health and catch potential issues early, which can lead to better long-term health outcomes.

- Increased Awareness of Healthcare Costs: Because HDHPs require you to pay more out-of-pocket before insurance kicks in, they can make you more conscious of healthcare costs. This increased awareness can lead to more informed decisions about when and where to seek medical care, potentially reducing unnecessary expenses.

- Flexibility and Portability: HSAs are portable, meaning you can take them with you if you change jobs or retire. This flexibility ensures that your savings for medical expenses remain accessible regardless of your employment status.

- Cost Savings on In-Network Services: HDHPs often negotiate lower rates with in-network providers, which can lead to significant savings on medical services. This means that even though you have a higher deductible, the overall cost of care can be lower when you use in-network providers.

- No Requirement for Primary Care Physician (PCP) Referrals: Unlike some traditional plans, HDHPs typically do not require you to get a referral from a primary care physician to see a specialist. This can save time and make it easier to access the care you need.

By understanding these benefits, you can better evaluate whether an HDHP is a suitable option for your healthcare needs.

Drawbacks of HDHPs

While High Deductible Health Plans (HDHPs) offer several benefits, they also come with notable drawbacks that can impact individuals differently based on their healthcare needs and financial situation. Here are some key disadvantages:

- High Out-of-Pocket Costs: One of the most significant drawbacks of HDHPs is the high out-of-pocket costs. Before your insurance starts to cover expenses, you must meet a high deductible, which can be financially burdensome, especially if you face unexpected medical bills. This can be particularly challenging for individuals who require frequent medical care or have chronic conditions.

- Financial Strain: The high deductibles and out-of-pocket maximums can lead to substantial financial strain. If you need extensive medical treatment early in the year, you might have to pay a large sum out-of-pocket before your insurance kicks in. This can be difficult to manage without sufficient savings or financial planning.

- Delayed or Skipped Care: Due to the high costs associated with HDHPs, some individuals may delay or skip necessary medical care to avoid out-of-pocket expenses. This can lead to worsening health conditions and higher costs in the long run, as untreated issues may become more severe.

- Limited Coverage for Non-Preventive Care: While HDHPs often cover preventive care services without requiring you to meet the deductible, non-preventive care can be costly until the deductible is met. This means that routine visits, prescriptions, and other non-preventive services can add up quickly.

- Risk of Being Underinsured: HDHPs can sometimes leave individuals feeling underinsured, especially if they have multiple or unexpected medical needs. The high deductible and out-of-pocket costs can make it difficult to afford necessary care, leading to financial stress and potential health risks.

- Complexity and Confusion: Understanding and managing an HDHP can be complex. The high deductible, coinsurance, and out-of-pocket maximums can be confusing, making it challenging for individuals to predict their healthcare costs and plan accordingly.

- Unpredictable Costs: HDHPs can lead to unpredictable healthcare costs. While you might save on premiums, unexpected medical events can result in significant out-of-pocket expenses, making it difficult to budget for healthcare.

- Limited Access to Immediate Funds: Even with a Health Savings Account (HSA), you might not have enough saved to cover high deductibles and out-of-pocket maximums, especially if you face a major medical event early in the year. This can create financial stress and limit access to necessary care.

- Limited Coverage for Certain Services: Some HDHPs may have limited coverage for specific services or treatments, requiring you to pay more out-of-pocket. This can be particularly problematic for specialized care or treatments not fully covered by the plan.

By understanding these drawbacks, you can better evaluate whether an HDHP is a suitable option for your healthcare needs.

Who Should Consider an HDHP?

High Deductible Health Plans (HDHPs) can be a great option for certain individuals and families, depending on their healthcare needs and financial situation. Here are some groups who might benefit from choosing an HDHP:

1. Healthy Individuals: People who are generally healthy and do not require frequent medical care may find HDHPs advantageous. The lower monthly premiums can save money, and since they rarely need medical services, the high deductible is less of a concern.

2. Young Adults: Young adults, who typically have fewer health issues, might prefer HDHPs due to the lower premiums. They can benefit from the cost savings while still having coverage for catastrophic events.

3. Financially Prepared Individuals: Those who have the financial means to cover high out-of-pocket costs if necessary are well-suited for HDHPs. This includes individuals who can afford to pay the deductible upfront or within a short period if a surprise medical expense arises.

4. High Earners: High-income individuals and families who want to take advantage of the tax benefits associated with Health Savings Accounts (HSAs) might find HDHPs appealing. Contributions to an HSA are tax-deductible, and the funds grow tax-free, providing significant tax savings.

5. People with Access to Employer Contributions: Employees whose employers contribute to their HSAs can benefit from additional financial support for healthcare expenses. This can help offset the higher out-of-pocket costs associated with HDHPs.

6. Those Seeking Preventive Care: HDHPs often cover preventive care services, such as annual check-ups and screenings, without requiring you to meet the deductible first. Individuals who prioritize preventive care can benefit from these services at no additional cost.

7. Individuals Who Value Flexibility: HDHPs often provide a wide network of providers and do not require referrals to see specialists. This flexibility can be appealing to those who want more control over their healthcare choices.

By considering these factors, you can determine if an HDHP aligns with your healthcare needs and financial situation.

Comparing HDHPs with Other Plans

When choosing a health insurance plan, it’s essential to understand how High Deductible Health Plans (HDHPs) compare with other types of plans, such as Preferred Provider Organizations (PPOs) and Health Maintenance Organizations (HMOs). Here’s a detailed comparison:

1. Premiums and Deductibles

- HDHPs: These plans have lower monthly premiums but higher deductibles. You pay less each month, but you must cover more out-of-pocket costs before your insurance starts paying.

- PPOs: Typically have higher monthly premiums but lower deductibles. This means you pay more each month but less out-of-pocket when you need care.

- HMOs: Generally offer lower premiums and deductibles compared to PPOs but require you to use a network of doctors and get referrals for specialists.

2. Out-of-Pocket Costs

- HDHPs: Higher out-of-pocket maximums, meaning you could pay more in a year before the plan covers 100% of costs.

- PPOs: Lower out-of-pocket maximums, providing more predictable costs for frequent healthcare users.

- HMOs: Often have lower out-of-pocket costs but less flexibility in choosing providers.

3. Flexibility and Provider Choice

- HDHPs: Often provide a wide network of providers and do not require referrals to see specialists.

- PPOs: Offer the most flexibility, allowing you to see any doctor without a referral and providing coverage for out-of-network providers, though at a higher cost.

- HMOs: Require you to choose a primary care physician (PCP) and get referrals for specialists. Coverage is typically limited to in-network providers.

4. Preventive Care

- HDHPs: Cover preventive care services, such as annual check-ups and screenings, without requiring you to meet the deductible first.

- PPOs: Also cover preventive care, often with no out-of-pocket costs.

- HMOs: Provide comprehensive preventive care within the network.

5. Health Savings Accounts (HSAs)

- HDHPs: Can be paired with HSAs, allowing you to save money tax-free for medical expenses. This is a significant advantage for those who want to manage their healthcare costs effectively.

- PPOs and HMOs: Generally do not qualify for HSAs, limiting the tax advantages available to you.

6. Suitability

- HDHPs: Best for healthy individuals, young adults, and those who can afford high out-of-pocket costs or want to take advantage of HSAs.

- PPOs: Suitable for individuals who want flexibility in choosing providers and do not mind paying higher premiums for lower out-of-pocket costs.

- HMOs: Ideal for those who prefer lower premiums and are comfortable with a more managed care approach, including using a network of providers and getting referrals.

By understanding these differences, you can make more informed decisions about which type of health insurance plan best suits your needs and financial situation.

Tips for Managing an HDHP

Managing a High Deductible Health Plan (HDHP) effectively requires careful planning and smart strategies to minimize out-of-pocket costs. Here are some practical tips to help you get the most out of your HDHP:

- Utilize Preventive Care Services: Take advantage of the preventive care services covered by your HDHP without requiring you to meet the deductible first. This includes annual check-ups, vaccinations, and screenings. Staying on top of preventive care can help catch potential health issues early and avoid more costly treatments later.

- Contribute to a Health Savings Account (HSA): If your HDHP is paired with an HSA, make regular contributions to it. HSAs offer tax advantages, such as tax-deductible contributions, tax-free earnings, and tax-free withdrawals for qualified medical expenses. This can help you save money and be prepared for unexpected medical costs.

- Shop Around for Healthcare Services: Healthcare costs can vary significantly between providers. Use tools and resources to compare prices for medical services and procedures. Choosing more cost-effective options can save you money without compromising on the quality of care.

- Use In-Network Providers: Stick to in-network providers whenever possible, as they have negotiated rates with your insurance plan, which can lower your out-of-pocket costs. Out-of-network providers typically charge higher rates, and your insurance may cover less of the cost.

- Save on Medication Costs: Ask your doctor if there are generic or lower-cost alternatives to your prescribed medications. Additionally, consider using mail-order pharmacies or discount programs to reduce medication expenses.

- Take Advantage of Wellness Programs: Many HDHPs offer wellness incentives, such as discounts on gym memberships, smoking cessation programs, and weight loss programs. Participating in these programs can improve your health and potentially lower your healthcare costs.

- Negotiate Medical Bills: Don’t hesitate to negotiate medical bills with healthcare providers. Many providers are willing to offer discounts or payment plans if you ask. This can help reduce your overall out-of-pocket expenses.

- Budget for Healthcare Costs: Plan and budget for potential healthcare expenses throughout the year. Setting aside money in an emergency fund or your HSA can help you manage unexpected medical costs without financial strain.

- Educate Yourself on Your Plan: Understand the details of your HDHP, including what services are covered, your deductible, coinsurance rates, and out-of-pocket maximums. Being informed can help you make better decisions about your healthcare and avoid unexpected costs.

Does Health Insurance Cover Chiropractic Care?

By following these tips, you can effectively manage your HDHP and make the most of its benefits while minimizing out-of-pocket expenses.

FAQs

Q 1. Can I switch from a traditional health plan to an HDHP mid-year?

Ans. Switching plans mid-year depends on your employer’s policies and the specific terms of your health insurance provider. Generally, changes can be made during the open enrollment period or if you experience a qualifying life event.

Q 2. How do I know if an HDHP is right for me?

Ans. Consider your healthcare needs, financial situation, and risk tolerance. HDHPs are often suitable for healthy individuals, young adults, and those who can afford high out-of-pocket costs or want to take advantage of Health Savings Accounts (HSAs).

Q 3. What expenses can I pay for with my HSA?

Ans. HSAs can be used to pay for a wide range of qualified medical expenses, including deductibles, copayments, prescriptions, dental care, vision care, and some over-the-counter medications.

Q 4. What happens to my HSA if I switch jobs or retire?

Ans. HSAs are portable, meaning you can take them with you if you change jobs or retire. The funds in your HSA remain available for qualified medical expenses regardless of your employment status.

Q 5. Are there any penalties for not meeting the deductible in an HDHP?

Ans. There are no penalties for not meeting the deductible. However, you will need to pay out-of-pocket for most non-preventive medical services until you reach the deductible.

Q 6. How do HDHPs handle emergency care?

Ans. Emergency care is typically covered by HDHPs, but you will need to meet your deductible before the insurance starts to pay. It’s important to understand your plan’s specific terms for emergency services.

Q 7. Can I use my HSA to pay for health insurance premiums?

Ans. Generally, HSA funds cannot be used to pay for health insurance premiums, except in specific situations such as paying for COBRA coverage, long-term care insurance, or health insurance while receiving unemployment benefits.

Q 8. What are the tax benefits of an HSA?

Ans. HSAs offer several tax advantages: contributions are tax-deductible, the funds grow tax-free, and withdrawals for qualified medical expenses are also tax-free.

Conclusion

In conclusion, whether a High Deductible Health Plan (HDHP) is good or bad depends on your personal situation. If you’re healthy and don’t need much medical care, the lower monthly premiums and the benefits of a Health Savings Account (HSA) might make an HDHP a smart choice. However, if you have regular medical needs or are worried about high out-of-pocket costs, an HDHP could lead to financial stress. It’s important to weigh the pros and cons carefully and consider how an HDHP fits with your health and financial goals before making a decision.

Shubham is a passionate insurance expert with years of experience in the industry. I write about home, auto, travel, life, and health insurance to help readers make informed decisions. My goal is to break down the details of coverage, costs, and claims in a straightforward, easy-to-understand way, so you can protect what matters most without the confusion.