If you live in Texas, you might have noticed that car insurance can be quite expensive. But have you ever wondered why? There are several reasons for the high cost of car insurance in Lone Star State. Many factors contribute to the rising premiums, from busy highways and frequent natural disasters to high vehicle theft rates and insurance company practices. In this article, we’ll explore these reasons in detail and provide some tips on saving money on your car insurance in Texas.

Why is Car Insurance So Expensive In Texas?

In Texas, car insurance tends to be expensive due to several factors. Here’s a breakdown of why premiums can be higher:

1. Urbanization and Traffic Density

Urbanization and traffic density are significant factors contributing to the high cost of car insurance in Texas. Major cities like Houston, Dallas, and Austin have seen rapid population growth, leading to increased traffic congestion and a higher likelihood of accidents. The dense traffic conditions in these urban areas result in more frequent collisions, which in turn lead to more insurance claims.

Insurance companies account for this elevated risk by raising premiums to cover the potential costs of these claims. Additionally, the high volume of vehicles on the road increases the chances of minor incidents, such as fender benders, further driving up the number of claims and, consequently, the cost of insurance. This combination of urbanization and traffic density makes car insurance more expensive for drivers in Texas’s bustling metropolitan areas.

2. Vehicle Theft Rates

Vehicle theft rates in Texas are a significant factor contributing to the high cost of car insurance in the state. Texas ranks as one of the top states for vehicle theft, with a rate of 320 thefts per 100,000 residents. This high incidence of car theft leads to increased insurance claims, as insurers must cover the cost of stolen vehicles and any associated damages.

Consequently, insurance companies raise premiums to offset these higher risks and potential losses. Additionally, certain models, such as full-size pickup trucks and popular sedans, are more frequently targeted, further driving up insurance costs for owners of these vehicles. The elevated risk of vehicle theft in Texas thus plays a crucial role in the state’s expensive car insurance premiums.

3. Natural Disasters

Natural disasters are a major factor driving up car insurance costs in Texas. The state is highly susceptible to severe weather events such as hurricanes, floods, hailstorms, and tornadoes. These natural disasters cause extensive damage to vehicles, leading to a surge in insurance claims. For instance, hurricanes can result in widespread flooding and wind damage, while hailstorms can cause significant dents and broken windows.

Insurance companies, anticipating these frequent and costly claims, raise premiums to cover the potential losses. Additionally, the unpredictability and severity of these events make it challenging for insurers to accurately predict risks, further contributing to higher insurance rates. As a result, Texas drivers face some of the highest car insurance premiums in the country due to the state’s vulnerability to natural disasters.

4. High-Speed Limits

High-speed limits in Texas significantly contribute to the state’s high car insurance premiums. Texas is known for having some of the highest speed limits in the United States, with certain highways allowing speeds up to 85 mph. This increased speed limit heightens the risk of severe accidents, as higher speeds reduce reaction times and increase the impact force during collisions.

Consequently, insurance companies face a higher likelihood of costly claims, leading them to raise premiums to offset these risks. Additionally, speeding tickets are common in Texas, and drivers with speeding violations often see their insurance rates increase by an average of 13%. This combination of high-speed limits and frequent speeding violations makes car insurance more expensive for Texas drivers.

5. Uninsured Drivers

The high number of uninsured drivers in Texas is a major factor contributing to the state’s elevated car insurance premiums. Approximately 14% of drivers in Texas do not have car insurance. This significant percentage increases the financial risk for insurance companies, as they often have to cover the costs of accidents involving uninsured motorists. To mitigate this risk, insurers raise premiums for all drivers.

Additionally, Texas law requires drivers to carry uninsured/underinsured motorist (UM/UIM) coverage unless they opt out in writing. This coverage helps protect insured drivers from the financial burden of accidents with uninsured drivers, but it also adds to the overall cost of insurance policies. The prevalence of uninsured drivers, therefore, directly impacts the cost of car insurance in Texas, making it more expensive for everyone on the road.

6. Repair Costs

Repair costs are a significant factor contributing to the high car insurance premiums in Texas. The cost of car repairs in the state is notably higher due to several factors, including labor costs and the price of parts. Texas has a large number of high-end and luxury vehicles, which are more expensive to repair.

The average cost of car repairs in Texas is around $397.53, which is higher than in many other states. Additionally, the labor rates for automotive repairs in Texas range from $140 to $145 per hour. These high costs mean that when accidents occur, insurance companies have to pay more to cover the repairs, leading them to charge higher premiums to offset these expenses. The annual cost of car maintenance in Texas can range from $948 to $2,523.

7. Insurance Regulations

Insurance regulations in Texas play a crucial role in determining car insurance premiums. The state mandates minimum liability coverage of 30/60/25, which means drivers must have at least $30,000 coverage for injuries per person, up to $60,000 per accident, and $25,000 for property damage. These requirements ensure that drivers have sufficient coverage to pay for damages and injuries they cause in an accident.

However, the stringent regulations also mean that insurance companies must maintain adequate reserves to cover potential claims, leading to higher premiums. Additionally, Texas law allows insurers to use credit scores to determine premiums, which can disproportionately affect drivers with lower credit scores. These regulatory factors, combined with the state’s high risk of natural disasters and high vehicle theft rates, contribute to the overall high cost of car insurance in Texas.

8. Lack of Public Transportation

The lack of public transportation in Texas significantly contributes to the high cost of car insurance in the state. Unlike many other states with well-developed public transit systems, Texas residents often rely heavily on personal vehicles for their daily commutes. This reliance results in a higher number of vehicles on the road, increasing the likelihood of traffic congestion and accidents.

Consequently, insurance companies face a greater number of claims, leading them to raise premiums to cover these risks. Additionally, the increased vehicle usage contributes to higher wear and tear, further elevating the frequency of insurance claims for repairs and maintenance. This combination of factors stemming from the limited public transportation options makes car insurance more expensive for Texas drivers.

9. Driver Behavior

Driver behavior is a critical factor influencing the high cost of car insurance in Texas. Risky driving behaviors, such as speeding, aggressive driving, and distracted driving, significantly increase the likelihood of accidents. For instance, drivers who engage in aggressive behaviors like tailgating or frequent lane changes are more prone to collisions, leading to higher insurance claims.

Additionally, the prevalence of driving under the influence (DUI) in Texas further exacerbates the issue, as drivers with a DUI conviction can see their insurance premiums increase by nearly 50%. Insurance companies raise premiums to offset the risks associated with these behaviors, resulting in higher costs for all drivers. Consequently, maintaining safe driving habits is essential for keeping insurance premiums manageable in Texas.

10. Age

In Texas, your age significantly impacts your car insurance rates. Younger drivers, especially teenagers, tend to pay the highest premiums. For example, a teen driver might pay around $203 per month for a liability-only policy. As you get older, the rates generally decrease. Drivers in their 20s pay about $149 per month on average. The lowest rates are typically seen in your 40s, 50s, and 60s. However, once you reach around 70 years old, the rates start to increase again. This pattern is due to the higher risk associated with younger and older drivers.

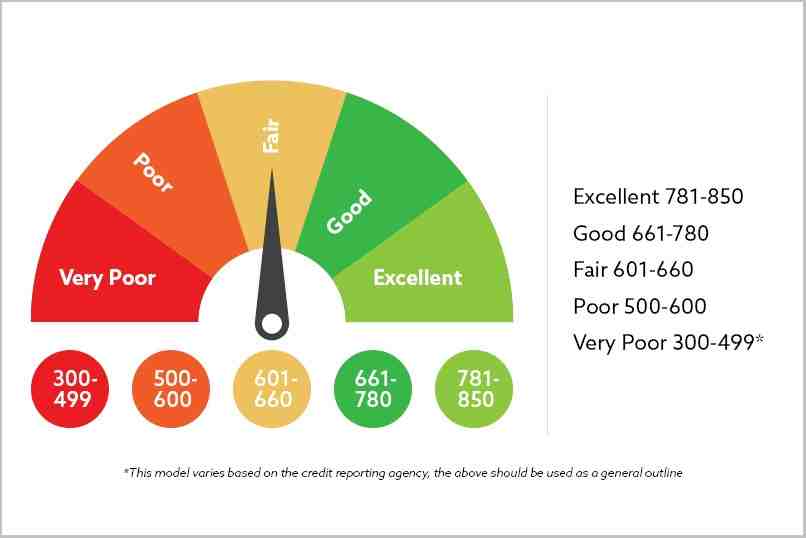

11. Credit Scores

Credit scores significantly impact car insurance rates in Texas. Insurers use credit-based insurance scores to predict the likelihood of a policyholder filing a claim. Drivers with lower credit scores often pay much higher premiums. For instance, drivers with poor credit can pay up to 80% more for full coverage compared to those with good credit.

On average, a driver with poor credit in Texas might pay around $1,462 more per year than a driver with good credit. This practice is based on studies showing that individuals with lower credit scores are more likely to incur losses on their policies. Therefore, maintaining a good credit score can significantly reduce car insurance costs in Texas.

Tips for Reducing Premiums in Texas

Reducing car insurance premiums in Texas can be achieved through several practical strategies. Here are some effective tips:

- Shop Around: Comparing quotes from different insurance companies can help you find the best rates. Prices can vary significantly, so it’s worth getting quotes from at least three insurers.

- Increase Your Deductible: Raising your deductible can lower your premium. For example, increasing your deductible from $200 to $500 could reduce your collision and comprehensive coverage costs by 15% to 30%.

- Bundle Policies: Many insurers offer discounts if you bundle multiple policies, such as auto and home insurance, with the same company.

- Maintain a Good Credit Score: A good credit score can significantly lower your insurance rates. Drivers with poor credit can pay up to 80% more for full coverage.

- Take Advantage of Discounts: Ask your insurer about available discounts. You might qualify for discounts for safe driving, having anti-theft devices, or even for being a good student.

- Drive Less: Reducing your annual mileage can lower your insurance costs. Some insurers offer discounts for low-mileage drivers.

- Improve Your Driving Record: Avoiding accidents and traffic violations can help keep your premiums low. Some insurers offer discounts for maintaining a clean driving record.

- Consider Usage-Based Insurance: Some companies offer usage-based insurance programs that track your driving habits. Safe drivers can benefit from lower rates.

By implementing these tips, Texas drivers can potentially reduce their car insurance premiums and save money.

FAQs

Q 1. What are the minimum car insurance requirements in Texas?

Ans. Texas law requires drivers to have at least 30/60/25 liability coverage, which includes $30,000 for injuries per person, up to $60,000 per accident, and $25,000 for property damage.

Q 2. How can I prove I have car insurance in Texas?

Ans. You can show your insurance ID card, a copy of your insurance policy, or a digital version on your smartphone.

Q 3. What are the penalties for driving without insurance in Texas?

Ans. Penalties can include fines, vehicle impoundment, and even suspension of your driver’s license.

Q 4. Does Texas require uninsured/underinsured motorist coverage?

Ans. While not required, it is highly recommended as it protects you if you’re involved in an accident with a driver who has insufficient or no insurance.

Q 5. Is my Texas car insurance valid if I drive in other states?

Ans. Yes, your Texas car insurance is valid in other states, but it’s a good idea to check with your insurer for any specific conditions.

Q 6. How does my driving record affect my car insurance rates in Texas?

Ans. A clean driving record can lower your premiums, while accidents and traffic violations can increase them.

Q 7. What should I do if I’m involved in a car accident in Texas

Ans. Exchange information with the other driver, take photos of the scene, and report the accident to your insurance company as soon as possible.

Q 8. Can I get a discount on my car insurance for having safety features in my car?

Ans. Yes, many insurers offer discounts for cars equipped with safety features like anti-lock brakes, airbags, and anti-theft devices.

Q 9. What is the average car insurance cost in Texas?

Ans. In 2024, the average annual cost of car insurance in Texas is $2,426 for full coverage and $693 for minimum coverage. These rates are slightly higher than the national averages, which are $2,329 for full coverage and $633 for minimum coverage. Monthly, this translates to about $202 for full coverage and $58 for minimum coverage. Factors such as age, driving record, credit score, and the type of vehicle can influence individual rates, making it essential for drivers to shop around and compare quotes to find the best deal.

Conclusion

In conclusion, car insurance in Texas is expensive due to a variety of factors. High-speed limits, urbanization, and traffic density increase the risk of accidents. Natural disasters like hurricanes and floods lead to more claims, while high vehicle theft rates and costly repairs add to the expenses. Additionally, state regulations and the use of credit scores by insurers can raise premiums. The lack of public transportation means more cars on the road, and risky driver behaviors further contribute to higher insurance costs. By understanding these factors, Texas drivers can take steps to reduce their premiums and make informed decisions about their car insurance.

Shubham is a passionate insurance expert with years of experience in the industry. I write about home, auto, travel, life, and health insurance to help readers make informed decisions. My goal is to break down the details of coverage, costs, and claims in a straightforward, easy-to-understand way, so you can protect what matters most without the confusion.